6 3.2: Notes Receivable Business LibreTexts

Square determines the amount to be charged for the loan and the percentage to be charged each day using data analytics. Each Square account has potentially different terms based on its history and trends. As mentioned earlier, if Anchor used IFRS the $480 discount amount would be amortized using the effective interest method. If Anchor used ASPE, there would be a choice between the effective interest method and the straight-line method.

Where Can Notes Receivable Be Found in the Balance Sheet?

This adjusting journal entry is needed to conform to GAAP, recording revenue in the month it is earned. Since cash isn’t changing hands until later, we record the amount in the Interest Receivable account to keep track of what will be due. Time represents the number of days (or other time period assigned) from the date of issuance of the note to the date of maturity of the note.

Streamline your accounting and save

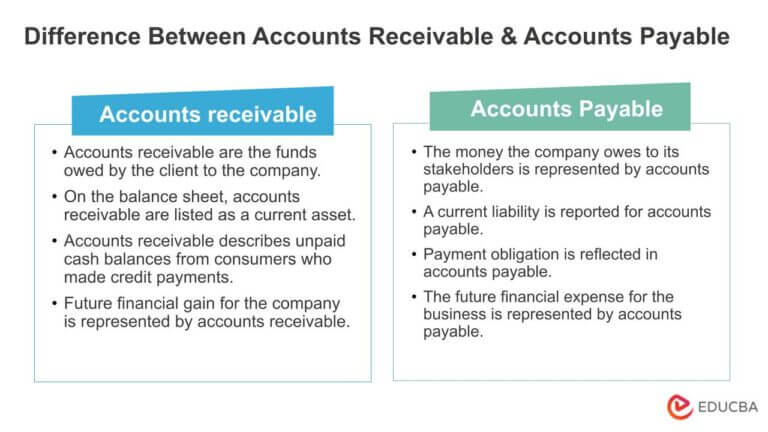

The remaining principal of the note receivable is reported in the noncurrent asset section entitled Investments. Notes receivable also represent money owed to a company, but under more formal terms. A note receivable is a promissory note documenting a loan made by the company that it expects to collect in the future. Understanding the differences between accounts receivable and notes receivable is crucial for anyone in accounting or finance roles. Although they sound similar, these two asset accounts have important distinctions.

Risk of Bad Debts

- The implied interest rate is calculated to be 5% and the note's interest component (rounded) is $2,165 (), which is the difference between the cash lent and the higher amount of cash repaid at maturity.

- When the investment in a note receivable becomes impaired for any reason, the receivable is re-measured at the present value of the currently expected cash flows at the loan's original effective interest rate.

- In most cases, the transaction between the issuer and acquirer of the note is at arm's length, so the implicit interest rate would be a reasonable estimate of the market rate.

- The date on which the security agreement is initiallyestablished is the issue date.

Interest Receivable is increased on the debit (left) side of the account and decreased on the credit (right) side of the account. Notes Receivable is an Asset account so it has a normal debit balance. Notes Receivable is increased on the debit (left) side of the account and decreased on the credit (right) side of the account. As per the above journal entry, debiting the Cash Account by $200,000 means an increase in Cash Account by the same amount.

The easiest way to deal with this is to write off the debt as uncollectable. When you know that a customer can't pay their bill, you’ll change the receivable balance to a bad debt expense. The accounts receivable aging report breaks down your outstanding invoices by how old they are. To create this report, you'll group your accounts receivable balances by the age of each invoice. Average accounts receivable is the beginning balance + ending balance divided by two. Let’s understand what accounts receivable is with the example of Lewis Publishers, who require 10,000 tons of paper for publishing books at the rate of $20 per ton.

Note Receivable amount represents the payment in full for the Note Receivable. On March 31 a similar entry will be made to record the interest revenue earned in March. On February 28 a similar entry will be made to record the interest revenue earned in February. Interest Receivable is an Asset account so it has a normal debit balance.

When a company receives goods or services but has yet to pay, it logs the amount owed as an AP entry. Typically, this involves the date of the transaction, the amount due, and the payment deadline. Another common receivable is Trades Receivable, which applies what is net working capital and how to calculate it whenever you make a sale of a product or service to a customer on credit. The only difference between Trades Receivable and regular Accounts Receivable or Notes Receivable is that these accounting entries are the direct result of a sale made by your company.

If the note is due after one year of the balance sheet date, it is classified as noncurrent or long-term. Sometimes the maker of a note does not pay the note when it becomes due. The $18,675 paid by Price to Cooper is called the maturity value of the note. Maturity value is the amount that the company (maker) must pay on a note on its maturity date; typically, it includes principal and accrued interest, if any. As shown above, the note's market rate (12%) is higher than the stated rate (10%), so the note is issued at a discount. Cash payments can be interest-only with the principal portion payable at the end or a mix of interest and principal throughout the term of the note.

When Lewis Publishers makes the payment of $200,000, Ace Paper Mill will increase the Cash Account by $200,000 and reduce Debtors or Accounts Receivable Account by $200,000. Implementing strong receivables management maximizes collections and minimizes write-offs or defaults. Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries.

প্রকাশক : মাসুদ রানা সুইট । সম্পাদক : আবুল হাসনাত অমি । নগর সম্পাদক : ইফতেখার আলম বিশাল নির্বাহী সম্পাদক : রুবেল আহম্মেদ । মফস্বল সম্পাদক : মোস্তাফিজুর রহমান । ব্যবস্থাপনা সম্পাদক : নীলা সুলতানা । বার্তা সম্পাদক : -------------- । সহ-বার্তা সম্পাদক : আলিফ বিন রেজা । সহ-বার্তা সম্পাদক :

Copyright © 2024 Dainiksopnerbangladesh.com. All rights reserved.